The Definitive Guide to Starting an ACCA Career in the UAE

Blog Structure

- Introduction

- Industry Insight: Market Demand

- ACCA Basic Details and Syllabus Overview

- Eligibility Criteria

- ACCA Duration

- Step-wise Process to ACCA Qualification

- ACCA Career Opportunities

- Best ACCA Jobs in UAE

- Salary Insights

- Tips/Mirchawala Promotion

- Conclusion

INTRODUCTION

Are you a finance aspirant and looking for a career guide? Or you are wondering how to secure your future in accounting? This blog is a savior for you. Explore through this complete guide on starting an ACCA career in the UAE to ensure a lucrative and fulfilling career in accounting, finance, and company management.

ACCA certification opens a door of opportunities for aspirants: global recognition, flexibility, and a variety of job options across industries. It helps you gain proficiency in auditing, taxation, and leadership, as well as financial management, and provides you with the tools you need to succeed in today’s progressive world.

As the finance profession’s code of conduct, regulations, and laws become more stringent, the demand for financial professionals with high levels of competence and ethics is increasingly going high. Hence, ACCA-qualified professionals are becoming more and more important to clients and potential employers.

Before choosing to enroll in this specific course, it is important to understand the opportunities and options that may arise. Hence, in the next section, we will discuss the importance and latest insights on ACCA.

Is ACCA Worth It? Significance and Industry Insights

ACCA is one of the most prominent and well-known course in the world. You get access to great ACCA career opportunities all over the world as an ACCA member. Because there is so much freedom, ACCA is not that hard. The course can be finished at your own pace.

The need for accountants is growing daily. This suggests that opportunities for becoming a chartered accountant, or a global chartered accountant, are also increasing. Data says that the need for certified public accountants has increased by 37%. Several multinational corporations, such as the Big Four consulting firms, employ Chartered Certified Accountants with alluring benefits packages for consulting, finance, and taxation. You can also think of starting your own business after ACCA and offering consulting services.

If you are still not sure about your decision to choose ACCA, check this article on – Is ACCA worth it? Find the Actual Answer with Key Advantages & Disadvantages

Now, you have clarity on the benefits of pursuing a career in ACCA. In the next section, we will cover the fundamentals of ACCA and the syllabus, followed by the ACCA course duration.

ACCA Basic Details and Syllabus

ACCA (Association of Chartered Certified Accountants) is the premier organization for professional accountants worldwide. ACCA is the biggest and most well-liked credential that equips you with the leadership, ethical, and technical abilities required to succeed in the financial industry. The aspirants need to qualify for 14 papers, a professional ethics module, and professional objectives spanning three years of work experience to pass the ACCA. The four sections of the 14 exams are as follows:

- Applied Knowledge

- Accountant in Business (AB)

- Management Accounting (MA)

- Financial Accounting (FA)

- Applied Skills

- Corporate and Business Law (LW)

- Performance Management (PM)

- Taxation (TX)

- Financial reporting (FR)

- Audit and Assurance (AA)

- Financial Management (FM)

You may be excluded from some or all of the fundamental papers, depending on your current level of education, and you can begin working on the professional papers right away.

- Strategic Professional

- Strategic Business Reporting (SBR)

- Strategic Business Leader (SBL)

- Advanced Financial Management (AFM)

- Advanced Performance Management (APM)

- Advanced Taxation (ATX)

- Advanced Audit and Assurance (AAA)

- Professional Ethics Module

To receive the ACCA certification, you must complete the Professional Ethics Module. After finishing papers F1, F2, and F3 in Fundamentals Knowledge, you can take it whenever you like. The module now takes about 20 hours.

Requirement for Professional Experience

You need three years of professional experience to become an ACCA-chartered accountant. During this period, you must accomplish four or more Options performance objectives in addition to nine Essentials. These goals help you apply your technical knowledge by connecting to various topics in the ACCA syllabus.

To learn more about practical experience requirements, read this blog: What Is PER In ACCA? How To Complete Your PER?

ACCA Course Duration

Many students could get qualified in about three or four years if they study for the ACCA while working. It will take longer if you choose to enroll in full-time classes before fulfilling your professional experience requirement. Before this modification, you had to finish the ACCA certificate within ten years. After completing your first professional-level exam, you have seven years to complete the ACCA. The Fundamentals papers can be finished at any time.

Any passes you have earned thus far are void, and you will need to retake them to obtain the ACCA qualification if you fail all of your professional papers within seven years. To help you better grasp the topic, check: ACCA Degree Duration. Hopefully, now that you are clear on ACCA, how many years to complete?

The following information explains eligibility, the step-wise process to obtain ACCA certification, and the best ACCA career options.

Eligibility Criteria for ACCA

Candidates must fulfill the eligibility requirements listed below to pursue the ACCA qualification.

- Educational Requirements: Candidates usually need three GCSEs (or comparable qualifications) in five disciplines, including English and mathematics, and at least two A-levels. ACCA does, however, provide exemptions for specific credentials, such as accounting degrees or similar degrees, which may exempt various ACCA exams.

- English Proficiency: ACCA exams are administered in English; thus, unless they have finished their schooling in the language, candidates must show that they are proficient in it using accredited assessments such as the TOEFL or IELTS.

- Age Requirement: ACCA is open to people at all stages of their professions because there is no minimum or maximum age requirement to enroll.

- ACCA registration: After fulfilling the requirements for eligibility, applicants can sign up as ACCA students and start the process of becoming qualified.

- Exemptions: You might qualify for exemptions from some ACCA exams based on your previous educational background.

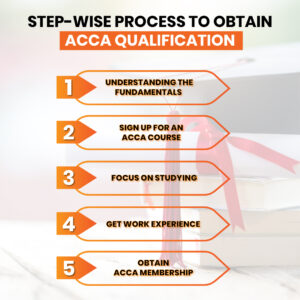

The ACCA (Association of Chartered Certified Accountants) credential is ideal for students who have a strong interest in accounting and finance. The internationally recognized ACCA degree in finance and accounting equips you for work in the audit, accounting, and finance industries. However, becoming an ACCA professional is not a simple process. It calls for commitment, diligence, and a love of the subject. Here is the step-wise process to obtain the ACCA certification:

Step 1: Understanding the Fundamentals.

Knowing the basics of the ACCA qualification is crucial before you start your journey. The Applied Knowledge tests are the first of three levels in the ACCA qualification, which leads to the Strategic Professional exams. Employers worldwide favor ACCA experts due to the qualification’s international recognition.

Step 2: Sign up for an ACCA course.

Enrolling in an ACCA program is the next stage in your ACCA journey. Get a comprehensive overview of the ACCA courses offered by the Mirchawala.

Step 3: Focus on Studying

It takes a great deal of commitment and effort to study for the ACCA tests. The difficult, practically oriented tests need a thorough comprehension of accounting ideas and principles. As a result, you will have to invest time in reading and understanding the study guides, practicing test questions, and attending webinars or workshops. There are many tools to support you, including study groups, online discussion boards, and ACCA YouTube channel.

Step 4: Get Work Experience

The ACCA requires you to obtain practical experience (PER) in pertinent accounting and finance in addition to completing the tests. Before you may join ACCA, you must finish 36 months of supervised experience. The ACCA qualification requires practical experience since it enables you to put the concepts and principles into practice you have learned.

Step 5: Obtain ACCA Membership

It’s time to apply for ACCA membership after you’ve completed all the requisite coursework and accumulated the required amount of real-world experience. Numerous advantages are available to you as a member, such as career assistance, networking opportunities, and tools for ongoing professional growth.

This was the five-step guide for starting an ACCA career in the UAE and any other regions. Now, let’s explore the best career options after the ACCA course.

Best ACCA Career Options: What Jobs Can You Do After ACCA?

Globally, the ACCA credential is accepted and acknowledged. Your career will soar when you become a chartered accountant. Here are a few significant career opportunities:

-

Finance Accountant

As a financial accountant, your duties will include monitoring budgets, making sure regulations are followed, and creating financial statements. Senior roles like Chief Financial Officer (CFO) or Financial Controller may follow from this function.

-

The Internal or External auditor

An auditor guarantees the accuracy of financial accounts and the efficacy of internal controls. With prospects to advance to positions like manager or partner in an accounting firm, you can specialize as an internal or external auditor.

-

Accountant for Management

Forecasting, budgeting, and assisting with strategic decision-making are the main responsibilities of management accountants. This position is essential for boosting company performance and offers prospects for advancement into positions like director or finance manager.

Explore more ACCA job options in the UAE: 10 Best Jobs in Dubai for ACCA Qualified Professionals.

ACCA Salary in the UAE: Expected Pay

An ACCA professional’s pay might vary greatly depending on several criteria, including work function, industry, location, and experience. However, because of their experience and widespread recognition, ACCA experts earn competitive wages.

For instance, entry-level ACCA practitioners in the UAE can anticipate making between AED 120,000 and AED 150,000 annually. In contrast, ACCA members with years of experience may make between AED 180,000 and AED 240,000 or more depending on their seniority and area of expertise.

Bottom Line

Starting an ACCA career is not a piece of cake, but you can transform your prospects in the global market by earning the ACCA certificate if you set your goals, put in the necessary effort, and acquire the required tools. The ACCA qualification is the key to the future, whether you are a recent graduate just beginning your career or an experienced professional hoping to advance in your field.

Begin your ACCA adventure now. Mirchawala’s Hub of Accountancy is there to help empower you and educate you through the journey. To know more about our courses and support, contact us NOW!