The Strategic Professional level, the final phase of the ACCA qualification journey, is designed to help candidates develop advanced abilities that will allow them to operate in senior roles in the accounting and finance industry. The professional-level exams assess the technical knowledge, strategic decision-making, and capacity to apply accounting concepts in intricate situations. Passing this exam and moving forward in your ACCA career depends on knowing how to approach and ace it. This blog provides a comprehensive overview of the ACCA Strategic Professional level exams, breaks down all the papers, offers professional advice on how to ace the exam, and explains the complete exam structure.

So, keep scrolling!

The ACCA Strategic Professional Exams: A Brief Overview

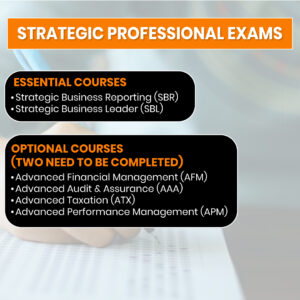

The ACCA Strategic Professional exams are the last ones in the ACCA course. These consist of two required courses, Strategic Business Leader (SBL) and Strategic Business Reporting (SBR), as well as several elective courses that allow for specialization in fields including taxation, advanced management accounting, and advanced financial management. The purpose of the ACCA Strategic Professional exam is to assess a higher degree of comprehension by emphasizing leadership, strategic thinking, and the capacity to handle challenging business situations. Passing these ACCA exams advances your ACCA career path and is a significant step towards earning the ACCA qualification.

1. Strategic Business Reporting (SBR)

The Strategic Business Reporting (SBR) paper focuses on the practical application of knowledge and comprehension of accounting concepts learned in FA (Paper 3) and FR (Paper 7) to assess, counsel, discuss, and clarify the accounting treatment and corporate reporting for a business transaction by financial reporting standards.

1.1 Strategic Business Reporting (SBR) Exam Structure

Reading and Planning Time: 15 minutes

- Section A: 30 Marks Question—51 Minutes, 20 Marks Question—34 Minutes (total 85 minutes)

- Section B: Two 25-Mark Questions—42.5 Minutes each (total 85 minutes)

- Final check: 10 minutes

1.2 Best Strategies for the ACCA SBR Exam

- First, become familiar with the material and exam format. Additionally, you must make a study schedule and follow it. This will ensure that you are well-prepared for the test and help you stay on course.

- Second, you should put in as much practice as you can. Completing previous exam papers is the best approach to accomplish this, since it will give you a sense of the kinds of questions you can anticipate on the test. Additionally, it will enable you to pinpoint any areas in which you need to increase your understanding.

- Third, when studying, remember to take regular breaks. This will allow your brain to relax and rejuvenate while also keeping you motivated and focused.

2. Strategic Business Leader (SBL)

ACCA SBL evaluates the ability to combine fundamental technical knowledge with key professional abilities. Candidates are expected to exhibit strategic thinking and decision-making skills in a single, cohesive document that mimics a real-world corporate setting. This SBL paper is special since it assesses the knowledge of business principles as well as the ability to strategically apply them in a work environment.

2.1 Strategic Business Leader (SBL) Exam Structure

SBL is a three-hour, fifteen-minute case study that includes three required assignments. There are 20 professional talents and 80 technical marks.

2.2 Top Three Tips for SBL Exam

- It is best to finish reading the study material in its entirety as soon as you can. Governance, ethics, strategy, leadership, risk management, internal controls, and other topics are covered in the course.

- Students should practice as many case studies as they can after reviewing the syllabus material to know what to expect from their exam responses. Begin with shorter case studies, ideally 20 or 30 marks, from the exam kit, and work your way up to a case study that is 100 marks long.

- When practicing, consult the model solution, as it will assist you in achieving a variety of points that may differ significantly from your own.

3. Advanced Financial Management (AFM)

Advanced Financial Management (AFM) exams are equipped to counsel clients or management on intricate strategic financial management issues that a firm may encounter. Its goal is to provide candidates the opportunity to show how they apply pertinent knowledge, strategies, and abilities while using professional judgment when making recommendations or making difficult decisions pertaining to a company’s strategic financial management.

3.1 Advanced Financial Management Exam Structure

The ACCA AFM exam lasts three hours and fifteen minutes. The two sections of AFM are Section A and Section B. Both sections allow for the examination of any portion of the syllabus.

- Section A: Single case study (50 marks)

- Section B: 2 questions of 25 marks each (50 marks)

- Total: 100

3.2 Succeed in the Advanced Financial Management Exam: Quick Tips

- Learn every subject on the syllabus. Spend more time on areas that need improvement and make changes regularly.

- You can become acquainted with the format of the test, the kinds of questions that will be asked, and the best use of time by practicing past AFM question papers.

- Examiner reports should be reviewed to learn about typical pitfalls and favored answering strategies.

4. Advanced Audit and Assurance (AAA)

The Advanced Audit and Assurance (AAA) exam aims to evaluate and go into great detail about the difficulties that auditors encounter in their line of work. In light of best practices and recent advancements, you will need to assess, analyze, and draw conclusions on the assurance engagement as well as other audit- and assurance-related issues. Because AAA has a lower pass rate than other ACCA papers, students generally see it as a difficult topic.

4.1 Advanced Audit and Assurance (AAA) Exam structure

The three-hour, fifteen-minute AAA exam consists of two components. Every question is compulsory.

Section A: 50-mark case study question, divided into multiple requirements

Section B: two 25-mark questions

4.2 Best Tips for Qualifying for the Advanced Audit and Assurance (AAA) Exam

- To fully understand the ideas and theories covered in the first level, thoroughly study the study text.

- Examine the case studies in the kit in great depth. Recognize how the conceptual notions learned in the study text are applied.

- Don’t put off studying until the end. Make sure you establish a methodical weekly schedule and consistently produce high-quality material.

5. Advanced Taxation (ATX)

The Advanced Taxation (ATX) helps students comprehend and analyze data in a corporate setting and successfully communicate the results. You must complete two of the four option papers for the Advanced Taxation exam. This paper might be extremely challenging if you don’t work in a tax-related field because it requires you to have a thorough awareness of the pertinent tax laws to interpret the results and provide clients with advice in the given scenario.

5.1 Advanced Taxation (ATX) Exam Structure

The ACCA ATX exam has a three-hour, fifteen-minute time limit and a 50% pass rate. ATX is computer-based as well as paper-based. You cannot pick one or the other; this depends on the region. All of the questions in the two sections of the ATX-UK exam are required.

- Section A: Two case study questions, one worth 25 points (including four professional marks) and the other worth 25 points. This section also includes five ethics marks, which emphasize the significance of having a solid understanding of ethical ideas at a strategic professional level.

- Section B: Two 20-mark questions that address a variety of personal and commercial tax topics.

5.2 How to Qualify for the Advanced Taxation (ATX) Exam

- Use a complete 12-week study cycle to get ready because the exams are quite difficult and the syllabus is extensive.

- There is no getting around the fact that practicing answering questions is the only way to fully understand the concepts in this curriculum.

- Since all of the exam’s questions are required, it is essential to plan for the entire paper and maintain a time management system.

6. Advanced Performance Management (APM)

The ACCA APM exam assesses the candidate’s aptitude for assessing and applying performance management techniques in practical settings. One of the exams, in the Strategic Professional Module, focuses on sophisticated performance management, analysis, and decision-making strategies. A thorough comprehension of the APM syllabus and the capacity to practically apply theoretical knowledge are prerequisites for passing this exam.

6.1 Advanced Performance Management (APM) Exam Structure

The APM exam consists of two portions, and the time duration is 3 hours and 15 minutes. Every question is compulsory.

- Section A: A 50-mark case study (40 technical and 10 professional skills) is included.

- Section B: Two questions (20 technical and 5 professional abilities) totaling 25 marks.

6.2 Tips to Qualify for the ACCA APM Exam

- Focus on practicing past exam questions to enhance your time management and answer structure.

- Take a thorough review of the paper, determine your knowledge gaps, and fill them.

- To qualify, stay updated with the most recent advancements and trends in performance management.

6.3 Bottom Line

The ACCA Strategic Professional Level is one of the most important stages of the ACCA course structure, where students learn advanced skills and knowledge that prepare them to take on leadership roles. To succeed in this phase, one needs well-organized ACCA course material, adequate preparation, and knowledgeable direction from a reputed institute like Mirchawala’s. Contact us to know more!

Frequently Asked Questions

Q1. What is the duration of the ACCA Strategic Professional program?

Ans: The ACCA Strategic Professional Level generally takes one to two years to complete, depending on the student’s schedule and speed.

Q2. Can I find a job after the ACCA Strategic Professional Level exam?

Ans: Yes, earning the ACCA Strategic Professional Level makes you qualified for a leadership role in management, accounting, and finance.