OVERVIEW:

If you are an ACCA aspirant or enthusiast you might have come across terms like ACCA Affiliate or ACCA member. One thing that is common in both of these terms is that individuals belonging to either of them have to go through ACCA exams and training. However, certain key differences set them apart. Read the blog to know the benefits of each title, what they have to offer, what makes them different, and which one is better in terms of career progression or professional security.

WHAT IS AN ACCA AFFILIATE?

An ACCA Affiliate is an individual who has completed their academic journey of ACCA (cleared all the required exams) and achieved the required work experience for ACCA qualification. But, the membership is still in process, hence, he won’t be considered a fully qualified ACCA member but an ACCA Affiliate. In easier words, an individual who completed all the requirements of ACCA Qualification and is in the process of waiting for ACCA membership approval is called an ACCA affiliate.

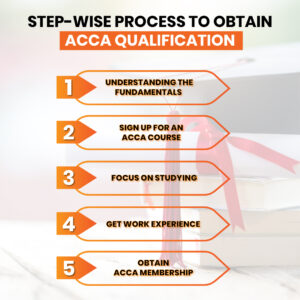

ACCA affiliates however have all the required knowledge and practice about the qualification and they can work under numerous financial or accounting roles but they do not have all the rights or benefits an ACCA member carries. Following is a breakdown of steps you need to follow to become an ACCA affiliate:

- Achieve success in all the ACCA exams, which cover a wide range of financial and accounting topics. For achieving this step get admission at Mirchwala’s hub of Accountancy.

- Complete the relevant work experience in the accounting or financial sector for 36 months, and record your professional accomplishments.

- Now submit your record and application to the body of ACCA’s Global and wait for the approval of becoming an ACCA member.

WHAT IS AN ACCA MEMBER?

An ACCA Member is someone who has completed all the academic and practical requirements of ACCA qualification, including the relevant work experience and approval of membership application. ACCA members are considered fully qualified professionals in the finance and accounting sector. And they can enjoy all the perks or privileges that come along with the title of an ACCA member. The following are the key features of an ACCA member:

- An ACCA member has completed all the steps like completing exams, practical training, relevant work experience, submission of work record along with membership application, and approval of membership application.

- Now, ACCA members can use the prestigious designation of ‘ACCA’ after their names, this is a big achievement in the accounting and financial world.

- ACCA members have numerous perks and rights such as voting in ACCA elections, get benefit from Continuous professional development (CPD), etc.

- Fully-qualified ACCA member their worth increases in the professional world, which may lead to higher potential salary and better roles.

KEY DIFFERENCES BETWEEN AN ACCA AFFILIATE AND A MEMBER:

Both, an ACCA affiliate and an ACCA member have strong knowledge and technical skills acquired from the qualification and practice. But the status of their title sets them apart in the professional world. Following are all the key differences between an ACCA affiliate and a member:

-

Status:

While ACCA affiliate are considered to be in a transitional phase, waiting for the membership approval. ACCA member is considered a fully-qualified, accredited and recognized professional in the industry.

-

Professional Title:

An ACCA affiliate is not allowed to use ACCA designation as of now. On the other hand, an ACCA member can use the ‘ACCA’ designation after his name.

-

Voting Rights:

An ACCA affiliate can not vote in ACCA elections. Whereas, an ACCA member can participate in voting.

-

Career Prospects:

Although an ACCA affiliate have all the skills and knowledge and can work under several professional roles but doesn’t career prospects as a member. ACCA members are likely to get paid higher and may be eligible for senior roles.

-

Professional Benefits:

An ACCA affiliate have limited access to the professional development resources. Whereas, ACCA members have full access to the Continuous professional development (CPD) as well as other networking opportunities.

WHY DOES THE DIFFERENCE MATTER?

The achievement of becoming an ACCA member isn’t limited to getting the title or distinction of ‘ACCA’ after your name only. Rather it also brings numerous professional perks, one of which is that an ACCA-qualified member tends to have higher salary potential and career exposure than an ACCA affiliate.

ACCA members also have a perk to stay updated with any changes in trends, regulations, or global accounting standards, this leads to professional development or career progression. Employers usually seek and prefer ACCA-qualified members over non-qualified accountants because of the fact that they are more likely to stay updated with current industry trends and changes.

CONCLUSION:

The main difference between an ACCA affiliate and an ACCA member is that one is an approved member of ACCA while the other is not or yet to be. Both, an ACCA affiliate and a member have cleared the ACCA exams and acquired academic knowledge and practical skills, completed relevant work experience (36 months). An ACCA affiliate is someone waiting for the approval of a membership application or is in the process of it while an ACCA member is someone who submitted relevant work records and applications and got approval of membership from the ACCA’s Global.

ACCA affiliates can work under various roles in the accounting and finance sector however, ACCA members are more likely to get high-paying jobs as compared to ACCA affiliates, and might as well get a senior position. Numerous other perks are enjoyed by ACCA members only, such as continuous professional development and networking opportunities, better job prospects, a distinction of ‘ACCA’, voting rights, etc. Nevertheless, ACCA membership takes you a step ahead in your career and is highly valued and appreciated by employers in the accounting and finance sector.