ACCA Exemptions for CA: Benefits, Claiming Process, and Eligibility Criteria Explained

In India, the Chartered Accountancy (CA) degree is highly competitive. Whether you have earned one already or are pursuing one now, you may be thinking about how you could boost your career scope overseas. Despite having considerable significance in India, the Association of Chartered Certified Accountants (ACCA) provides access to a worldwide accounting profession due to its recognition in more than 180 countries.

Let’s start with some good news. As a CA professional or student, you can take advantage of significant ACCA exemptions, so you don’t have to start from zero. This blog has all the information you require related to the ACCA exemption for CA candidates, including requirements, expenses, and the application procedure.

Is ACCA Worth Doing After CA?

Since ACCA has a passing percentage of 40–50% and CA has a 4-5% passing percentage, chartered accountants are in higher demand than ACCAs. It is always worthwhile to do ACCA after CA. Your skill set would grow as a result, and you would gain international recognition. You would have several opportunities as a result. You will need to pass four papers because you have nine exemptions.

Many people believe that ACCA is solely for people who want to live overseas. In actuality, ACCA offers a fantastic career scope both outside and in India. Pursuing a globally recognized certification such as the ACCA is the only way to attain such global competitiveness.

To assist you in finding internships and career placements, ACCA maintains a specialized job portal with over 7300 approved organizations. There are hundreds of positions listed on jobs.accaglobal.com, which may be viewed by sector, job role, and nation. Bookkeepers, business analysts, financial accountants, management accountants, tax consultants, forensic accountants, treasurers, finance business partners, and many more are included in this broad category of occupations. Additionally, occupations are found in a wide range of industries, including public practice, banking and financial services, digital, healthcare, education and training, and defense and military.

How to Claim ACCA Exemptions for CA

When looking to take advantage of the ACCA exemptions for CA, consider the following crucial factors:

1. Check Your Qualifications & Work Experience

If you work as a CA or have recently obtained a CA qualification, you may be eligible for exemptions. This is because every topic will be new to you.

2. Time Passed Since Qualification

If you haven’t held the relevant position for a while and your qualifications have expired, don’t claim exemptions. A lengthy lapse may have caused you to overlook certain crucial subjects. Studying for the ACCA exam would be more sensible in this case since it would allow you to brush up on your knowledge.

3. Assess Your Preparation

If you can’t decide, try looking at previous exam papers and trying to answer the questions.

Compare your responses to the mock paper answer; if you are sure that you can pass the exam, apply for the exemption or think about studying for every paper.

4. Consider the Costs

Filing for exemptions can result in savings on tuition and study materials. Nonetheless, the ACCA still requires payment of an exemption fee equal to the exam fee for the paper.

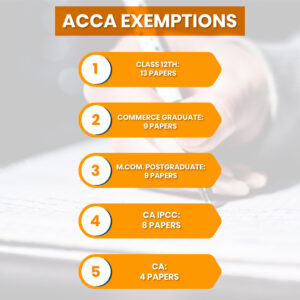

5. ACCA Exemption For CA and CA Inter Students

As a CA student, you can claim 9 exemptions out of 13 papers. The exempted subjects are

- Business and Technology (BT),

- Management Accounting (MA),

- Financial Accounting (FA),

- Corporate and Business Law (LW),

- Performance Management (PM),

- Taxation (TX),

- Financial Reporting (FR),

- Audit and Assurance (AA),

- Financial Management (FM).

CA inter students are eligible for five ACCA exemptions. Only after passing both CA IPCC groups can you take advantage of these exemptions. Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA), Taxation (TX), and Audit and Assurance (AA) are among the exempt disciplines.

For CA foundation students, there are no exceptions.

Additionally, you receive four exemptions in the following subjects: Business and Technology (BT), Management Accounting (MA), Financial Accounting (FA), and Corporate and Business Law (LW) if you have a BCom or MCom degree.

How to Request ACCA Exemption

Exemptions can be applied for in two ways. First, when registering on the ACCA website, candidates can request exemptions. Another choice is to send materials to ACCA via email.

Along with award certificates or academic transcripts, you will need to present official documentation of your CA qualification. The ICAI should sign the paperwork.

The ACCA will evaluate your qualifications and decide whether or not you qualify for exemption based on the evidence you provide.

You can request a renewal exemption if, after enrolling in the ACCA course, you have obtained additional certifications. You must, however, submit your application for the exemption at least 20 days before the exam entrance deadline.

ACCA Exemption Benefits Following CA

These are some key benefits the ACCA exemptions for CA:

- Time Savings: Students can speed up their ACCA learning journey and save a lot of time by claiming exemptions in specific courses.

- Cost-Effective: CA students can save money on study materials, tuition, and examination costs for particular papers by using exemptions to bypass some exams. This cost-effectiveness is advantageous, particularly for individuals with limited funds or looking to reduce financial stress while pursuing their ACCA studies.

- Morale Boosting: Exemptions acknowledge the knowledge and skills acquired by CA certifications. Students’ confidence is greatly boosted by this alone.

Bottom Line

CA-qualified professionals and students have an excellent opportunity to expedite their journey to becoming globally renowned chartered accountants through ACCA exemptions for CA. By taking advantage of these exemptions, aspirants can save time and money while simultaneously increasing their career opportunities worldwide.

Students need to just make sure they understand all of the prerequisites, including charges and exemptions, if they intend to apply for ACCA after CA. Take ACCA admission at Mirchawala’s Hub of Accountancy for personalized guidance and support. As an ACCA-certified learning partner, we can help you expedite the exemption and registration process so you’re ready for success on your ACCA journey.

Frequently Asked Questions (FAQs)

Q1: Is ACCA Worth Considering After CA?

Ans: Pursuing ACCA in India is the best decision for those professionals looking to work for multinational corporations (MNCs) or pursue opportunities outside of India. Certified accountants (CAs) are among the most respected accounting professionals in the country. Professionals with CA certificates can complete the ACCA qualification more quickly and affordably by using the applicable ACCA exemptions for CA.

Q2: Can you do ACCA during your CA Article ship?

Ans: Of course, you can complete both your CA and your articles! It will also benefit your studies for your CA course. You will receive your ACCA membership as soon as you complete the course because the CA article ship will be regarded as practical experience in ACCA as well.

Q3: What are CA’s ACCA exemption fees?

Ans: Students need to pay a fee for each subject exemption they request. The applied knowledge level test has an exemption cost of £84 per paper, whereas the applied skill exam has an exemption fee of £114 per paper.

Q4: Is ACCA better than CS?

Ans: The responsibilities of a CA(SA) above are mostly the same for those who pursue an ACCA qualification. The ACCA and CA(SA) syllabi share a lot of commonalities. The primary distinction between the two is that an ACCA is a worldwide qualification or a global professional degree, while a CA(SA) is a local qualification.

Q5: What are the 4 papers for ACCA after CA?

Ans: Out of the 13 ACCA papers (F1 through F9), an Indian chartered accountant is eligible for up to nine exemptions. By just passing the four papers, you can begin your professional qualification with ACCA exemptions for CA.

Q6: Which is the best online ACCA institute in India?

Ans: While there are many leading names for the ACCA courses in India, Mirchawala’s is an ACCA-approved premium provider with a notable industry reputation and a huge number of students worldwide.